The most powerful central bank in the world, the Federal Reserve Bank of America states that it has a dual mandate:

- Maximum Employment

- Stability in Prices or Low and Stable Inflation

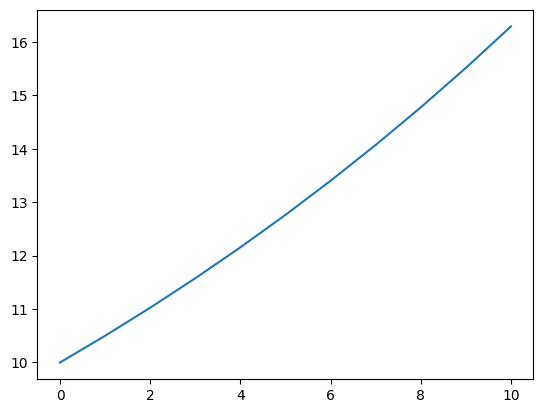

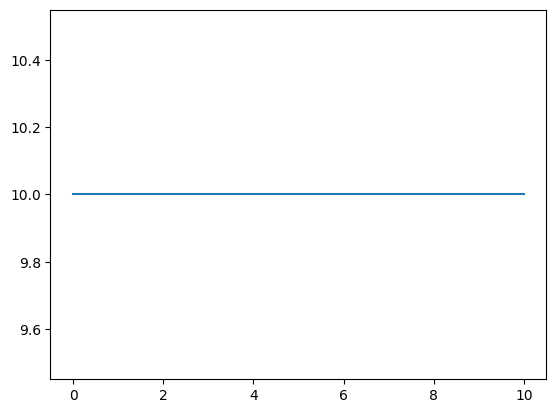

First let us take a note on the 2nd mandate. A stable price and a stably inflating price should not be equated as similar concepts. On the left side you can see a starting capital of 10$ growing at an annual compound rate of 5% and on the wright side you can se a starting capital of 10$ stable for 10 years.

Hopefully pictures speak louder than words and they illustrate the point above.

No inflation, which would constitute true stability, would ensure that the wealth created over one’s lifetime would be stable.

Stable inflation, which would NOT constitute true stability, would ensure that the wealth created over one’s lifetime would erode over time. Erosion at a stable rate is still erosion.

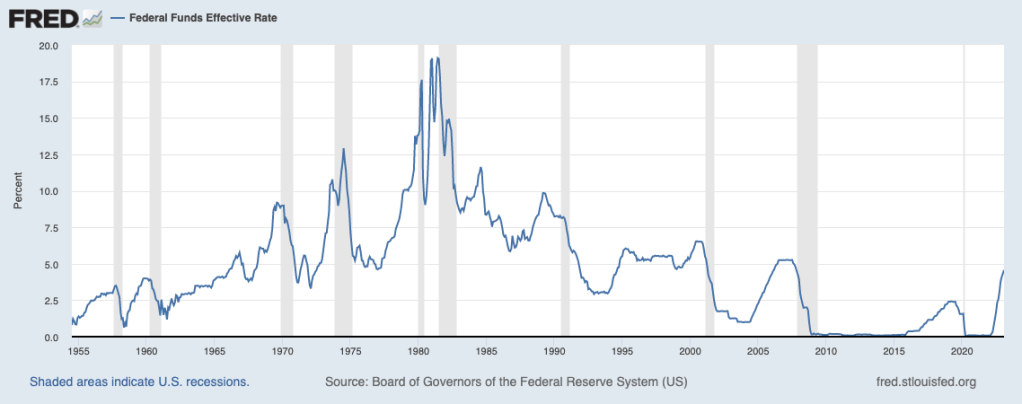

But, alright, if a Central Bank could set a stable rate of inflation over many decades then at least this 2nd mandate would be honoured in principle. Below is a graph of the FED interest rates from 1955 and onwards.

Hopefully, again, pictures speak louder than words and they reveal that this is not really a graph that demonstrates stability. One could argue that this is closer to the definition of instability.

Now let us consider the 1st part of the mandate: maximum employment.

There are really no tools in a Central Bank’s arsenal that can influence directly the job market. A Central Bank cannot employ people, other than the people it employs internally for the institution to function. It cannot mandate other institutions public or private to issue jobs and employ people. Employment is more of a fiscal and political issue rather than a Central Bank one. At best a Central Bank can be accommodating for a government to execute specific job market stimulatory policies and maybe guarantee some stability in the banking sector.

So really at first glance, the power a Central Bank holds can become a thickly veiled mystery. It is certainly not straightforwardly derived from its stated mandate. In fact, taken word for word, historically every Central Bank in existence has failed to uphold this mandate.

Every time an analyst, or anyone in general, makes a claim that a Central Bank can fix or prevent a recession, influence prices or the job market, one has to wonder: how?

It is a safe statement to make that nobody likes recessions. But if Central Banks could prevent them, why don’t they? Apart from conspiracy theories, the obvious answer should be: because they don’t have the power to do so. They don’t have the power they state they have and more over they don’t have the power most people think they have.